Cryptocurrency Company Coinbase Launches in The UK

Starting this May, customers in the UK will able to use sterling as well as US dollars in their Coinbase wallets as it becomes available in Britain for the first time. Coinbase will also allow for speculation of pounds and euros against bitcoins on its financial exchange.

UK regulators have taking a promising view of bitcoin, looking at it in a balanced way and trying to understand the technology in their regulations. Technology innovations have also fuelled the new move of Coinbase into the UK’s competitive market, which have been praised by Coinbase co-founder Fred Ehrsam. It is likely that this has also been down to the type of company that Coinbase is- in a strange and sometimes illegal bitcoin world, Coinbase has been trying to rid the currency of the negatives beliefs that many have held against it since it was first publicised two years ago.

Even as a very young currency, bitcoin has become linked to scams and theft as well as the narcotics trade through black market sites such as Silk Road. Despite its dark reputation, Coinbase is the largest of a group who want to keep dealings legal and change the view of bitcoin in the public eye.

When Coinbase was founded in June of 2012 the price of the bitcoin was $6 compared to $225 at this time and the company has raised $75m in funding as well as receiving the backing of the technology industry. Coinbase is now valued at $400m, making it the biggest bitcoin firm. Many large banks across the world and the New York Stock Exchange have backed Coinbase and the company now offers many helpful services for users of bitcoins.

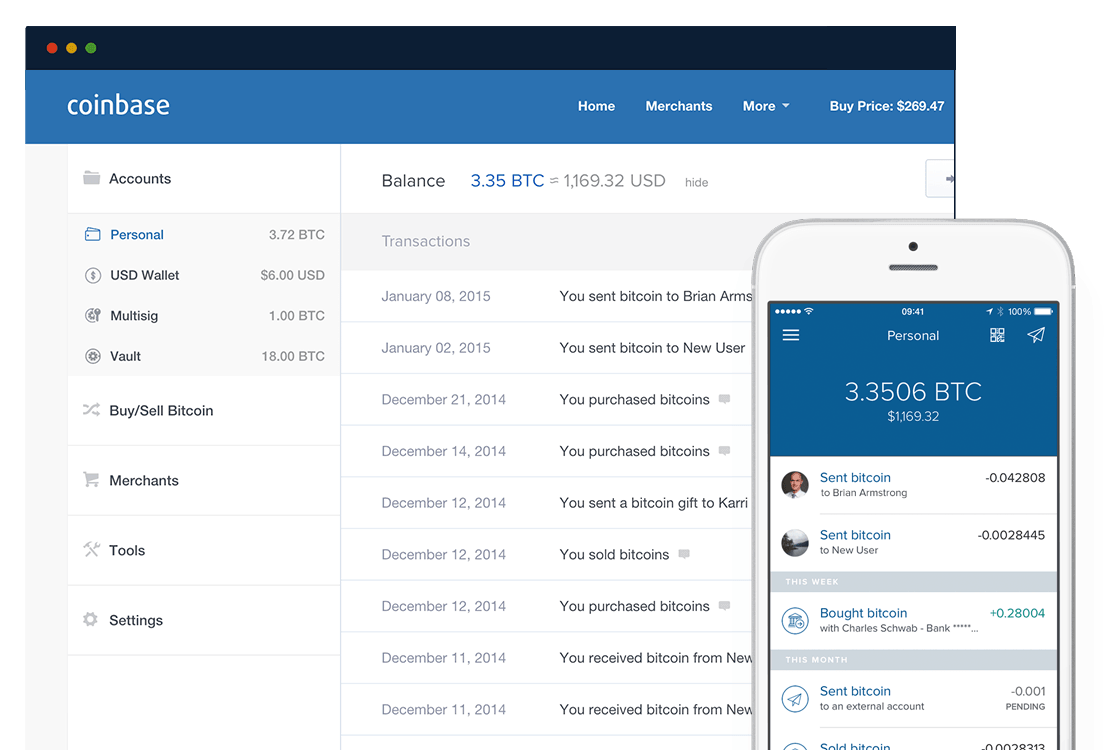

The cryptocurrency site launched an exchange in January of this year which has quickly become the most liquid exchange in the US and will more than likely become the most liquid bitcoin exchange that trades in US dollars throughout the world. Coinbase is used as a payment gateway for merchants to accept bitcoin on their sites, acts as a wallet for customers to spend the currency as well as running the foreign exchange for the bulk selling and buying of bitcoin.

Dell trialled Coinbase’s services in Britain and in February became the biggest UK company to accept bitcoin for sales. Following this, businesses can now sign up for merchant accounts to accept bitcoin on their sites and convert the payments into pounds to deposit into their bank account. Coinbase has managed so far to bring a niche currency to the mainstream- a the beginning of last year the merchant had no business partners but by the end of the year it had handled over $1bn in revenue for more than 10 large businesses.

Dell trialled Coinbase’s services in Britain and in February became the biggest UK company to accept bitcoin for sales. Following this, businesses can now sign up for merchant accounts to accept bitcoin on their sites and convert the payments into pounds to deposit into their bank account. Coinbase has managed so far to bring a niche currency to the mainstream- a the beginning of last year the merchant had no business partners but by the end of the year it had handled over $1bn in revenue for more than 10 large businesses.

Despite its success, Ehrsam says that in a way similar to email providers, users can easily switch bitcoin service providers without cost to themselves as Coinbase is compatible with the whole of the bitcoin network. Even so, Coinbase has been dubbed as the ‘AOL of Bitcoin’ as it can bring a new currency to millions just as the AOL internet service provider brought millions to the web.

While the company looks to be growing, the future of the cryptocurrency seems a little less uncertain. From when Coinbase was first formed, one bitcoin has gone from $6 up to $1200 at the end of 2013 and is now static at $225. Since January of this year the price has not moved, which makes one wonder if bitcoin is such an exciting and lucrative currency as it used to be. It did shoot to fame for the fact that those who had invested their money at the start were now holding a very valuable currency. Despite the current plateau, Ehrsam says that Coinbase has been through the cycle at least three times- there’s a plateau, an increase in price and then a ‘bust’ but the currency ends up at a higher plateau than before.

Coinbase predicts that the launch of its exchange services in particular in the UK will bring a combination of everyday people, ‘hedge fund guys’ and institutional players. Ehrsam expects a shift towards large institutional players over time. However for merchant services there may be many more everyday people using bitcoin to pay for their goods and services, and also to hold sterling as bitcoin in their online wallets, as they at least try to keep their money away from the UK banking system.